Costs Just Keep Going Up

MBA recently released its latest Quarterly Performance Report for the first quarter. The total sample of 366 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 5 basis points (or $223) on each loan they originated – the lowest level since the fourth quarter of 2018 and well below the quarterly average of 55 basis points dating back to 2008.

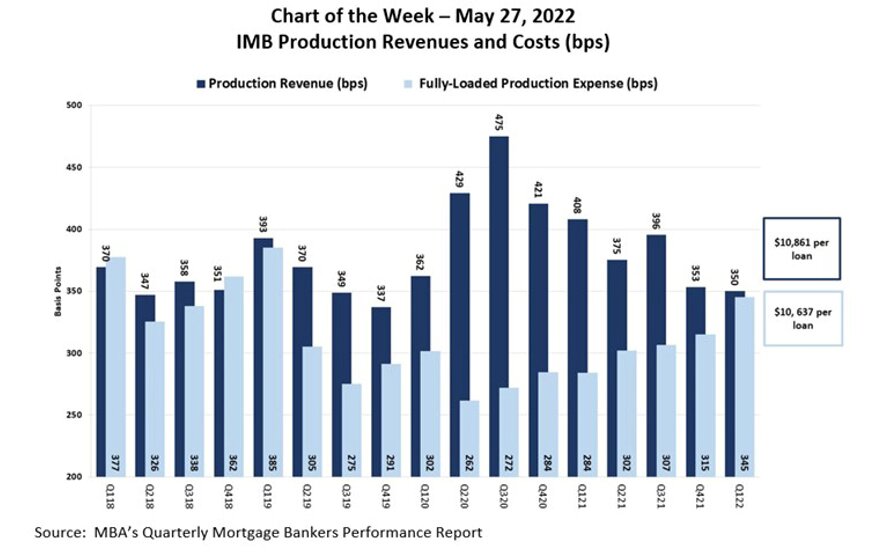

This week’s Chart of the Week shows production revenues compared to production expenses from the first quarter of 2018 to the first quarter of 2022. Total production revenue (fee income, net secondary marking income, and warehouse spread) decreased to 350 bps in the first quarter of 2022, down from 353 bps in the fourth quarter of 2021 and 408 basis points from one year ago.

While lower production revenue contributed to scant profit margins, the primary driver was cost. Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses, and corporate allocations – increased to 345 basis points in the first quarter from 315 basis points in the fourth quarter. On a per-loan basis, production expenses ballooned to a new study-high $10,637 per loan in the first quarter, up more than $1,000 per loan from the fourth quarter and more than $2,500 per loan from one year ago.

Introducing Efficacy, Efficiency, and Cost Effectiveness in the mortgage process

Manufacturing mortgage loans are getting expensive due to their labor-intensive nature and the complexity of the process. Due to the time and money needed to process a single loan, mortgage lenders are constantly striving to find ways to reduce cost, improve quality, and reduce cycle time.

As we talk to the mortgage company leadership regularly, the following are the items where we think if the mortgage companies focus, they can significantly reduce the time and cost involved in the process and improve customer and employee satisfaction.

Since 2020 the speed at which companies are moving towards digitizing is increased enormously. Still, there are other human factors too on which, if companies focus, they can improve their process and, in turn, provide value to the borrowers.

External Admin Support

Due to the volatile nature of the mortgage markets, every other year, you either have to increase your workforce significantly or right-size due to the compression in the margins. There are several ways to handle the same one of the proven methods is to hire expert external consultants; in one of the studies conducted by Oxford Economics, “83% of executives worldwide say they are increasingly using contingent, intermittent, or consultant employees.”

Following are the benefits you can attain by hiring expert LOS Admin support consultants.

Process Improvement: Normally, LOS Admin Consultants are hired to fill the skill gaps or resource shortages, but additionally bring fresh ideas and new ways of working, which they have learned from working with several other mortgage companies; this improves the existing process at the same time, introduces efficiencies.

Increased Productivity: When a consultant comes in, they have a standard ticketing system that helps them push issues immediately. This will help the internal project team focus on value-added items and allow them to be more productive.

Dedicated & Focused: Normally, mortgage companies assign specific projects to external teams, and the external team focuses on completing the tasks in the time they have quoted; that way, they are focused and dedicated, which will help to finish the high-value project in the best possible time.

Cost Effective: External LOS Admins are only cost for their productive hours. All the other activities like meetings, leaves, office gossip, and other non-producing activities are not costing the company anything. At the same time, no overhead costs, including healthcare, paid time off, holidays, etc.

Coaching & Knowledge Transfer: Good LOS Admin resources keep them up to date with the latest updates and skills in their field, and great ones tend to transfer the knowledge and provide coaching to their clients; that way, the mortgage companies will get long-term benefits.

Attract & Retain the Best Talent in the Industry

Any intelligent and talented employee would know their value and want to maximize the value they are getting in return. A significant part of what an organization can provide is to compensate the star players adequately so they feel motivated and deliver their best daily. Motivated employees are less likely to look for opportunities outside their current working environment. A significant challenge that the mortgage-industry faces in compensating employees are calculating the compensation because it is calculation intensive. At the same time, it needs to be processed every fortnight, if not weekly.

We think you should look at the top five picks before signing up for any new compensation tool or if you are doing your compensation manually.

Ease of Compensation Plan setup: A mortgage compensation plan is not simple as other industries. You have to consider total volume, total loan count if the resource has worked as a loan officer assistant, any deductions, individual bonuses, team bonuses, etc., so a good tool should have an intuitive interface to set up compensation plans.

Automated Calculations: Calculations are at the core of any compensation plan; as more factors add up, the calculation gets more complicated, and performing the analysis for a large team is difficult. The tool you are opting for should’ve automated calculations built in.

Automatic Workflows: One of the integral features which your compensation application is that it should’ve multiple approval workflows so it can be approved by Branch Managers, Regional Managers, or higher-ups for senior positions or high payouts.

Robust Notification: Applications need to keep the users informed about the status of essential events; your compensation system should have a dynamic notification system to suffice this requirement.

Slick Reporting: Provides easy-to-access robust data to CEOs and managers about their team and their production to make educated decisions which may include which employee they might desire to cultivate to grow their business, how much is being spent on compensation, and how much is being spent on events for LO’s. Etc.

Automating your processes

Several labor-intensive tasks make loan creation an expensive process, like collecting and entering data to the LOS, ordering services like flood, title, etc., sending disclosures, document ingestion, and stare/compare operations.

Following are the benefits you will get once you implement an automation plan for your mortgage company.

Reduce Cycle Time: The number one benefit of implementing automation in your processes is reducing the time required to close a mortgage loan.

The same will result in reduced costs and increased efficiencies. At the same time, it will increase your volume by delivering more loans in less time.

Data Accuracy: Automation helps you reduce data entry errors; at the same time, if it is a logic-based decision, automation will always make the right decision, as it is emotion-less; in turn, it will improve the accuracy of the data entered into the system which will result in increased quality of your loan process.

Compliance & Risk Mitigation: Whatever any automation engine does, there is a log for what is being done and the logic of why it is done. The same will help you improve your compliance as the actions and decisions are increasingly based on logic and all the steps are recorded. As the higher quality verified data is ingested in the system due to automation, it will produce more compliant results and provides a higher degree of risk mitigation.

Agility: The mortgage industry has ups and downs every few years, and the contracting workforce is challenging. If your company cannot manage the transitions, you will either lose business or dollars. Due to automation scaling up and scaling down is a matter of clicking a few buttons.

Improved Customer Experience: Convenient and fast loan processing matters most to today’s customers. Automation will enable more rapid response time, personalized experience, and consistency within Omni channels. This will improve customer experience and make your company differentiate from other competitors.

In conclusion, if you want to be ahead of the crowd, you should look for an opportunity to hire an external consultant, make your compensation straight by adapting a good mortgage compensation tool and optimize your processes using automation.

VP of Sales at Awesome Technologies, Kerry Mitchel has contributed to the finance industry for over 10 years, working in several departments from consumer loans to business loans, and mortgages. She carries a wealth of knowledge and experience and is excited to share it with others.