How Are Your Customers Computing Mortgage Payments When They’re Looking At Houses?

This is a question every mortgage originator needs to ask themselves. Why? Because there’s a new, silent “competitor” in town that’s betting they can be the payment calculator of choice for YOUR borrower.

We live in a monthly payment world. Car dealers figured out long ago that the most effective advertising featured a vehicle’s monthly payment, not price, and today, actual vehicle prices have become but a footnote.

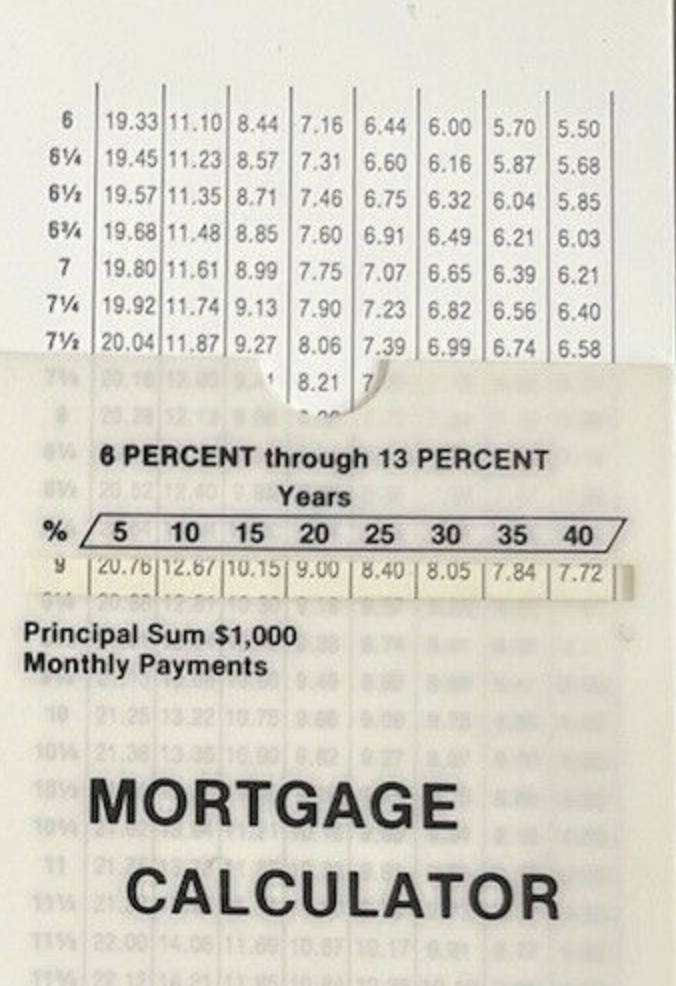

Mortgage loan officers know this as well. Veteran loan officers will remember handing out sliding paper calculators for payment estimates since borrowers didn’t have access to the all-powerful HP-12c.

Of course, times have changed. Every borrower walks around with a device in their pocket capable of finding any piece of information they want. For prospective homebuyers, this often includes Googling things like “mortgage calculator” to help them figure out what a payment might be on a particular house.

The bad news for today’s originator is that these online calculators are not innocuous websites built by altruistic web developers for the greater good. Instead, these are well-designed lead-generation magnets utilizing highly sophisticated technology with one goal: To redirect your customer to another lender.

Try it for yourself. Head to Google and type “Mortgage Calculator”. You’ll see the first page loaded with cute-sounding names like NerdWallet, BankRate, and SmartAsset. Clicking through to the results, you’ll find exactly what you’re looking for; slick and easy-to-use calculators with sexy charts and graphs. You may notice some onscreen, thinly-veiled advertisements from competitors, but what you won’t see is the army of tracking pixels behind the scenes, mobilizing to put click-worthy mortgage content in front of you for the next three months.

These “competitors” are generating billions of dollars in revenue (NerdWallet $380M in 2021 alone) by anticipating your borrower’s payment questions, nailing the SEO, and selling your borrower to the highest bidder, all without having to originate a single loan.

Originators, of course, can fight back. It’s silly to think that a pre-qualified borrower would seek this information elsewhere; however, most loan officers send borrowers off with little more than a PDF pre-qual letter and a static payment and closing cost summary. Every loan officer knows that the second a borrower looks at a house, the wheels begin turning with different scenarios. Tomorrow’s successful loan officers curate digital experiences for their borrowers that answer these questions without the borrower seeking this information elsewhere. Borrowers want customized mortgage calculators that present scenarios using the THEIR qualification criteria that are 100x more accurate than what they can find online.

How are your customers computing mortgage payments when they’re looking at houses? If you don’t know, I’ve got some bad news.

With QuickQual by LenderLogix, your borrowers and Realtors can run scenarios and update their own pre-qualification and pre-approval letters. Intrigued? Learn more now.

Patrick O’Brien is a mortgage banker turned technology at LenderLogix. He worked as a residential mortgage banker for a large regional financial institution for 15 years. Having been a successful retail loan originator, Patrick understands the importance of the lender/realtor relationship and helped create LenderLogix from a banker’s perspective. Patrick has a passion for process improvement and led initiatives to bring efficiencies to the mortgage process. He’s advised on several major LOS implementations and consulted throughout design, testing and implementation. Patrick is a graduate of the University at Buffalo and lives in Buffalo, NY.