Share Of Mortgages In Forbearance Decreases To 1.30% In January

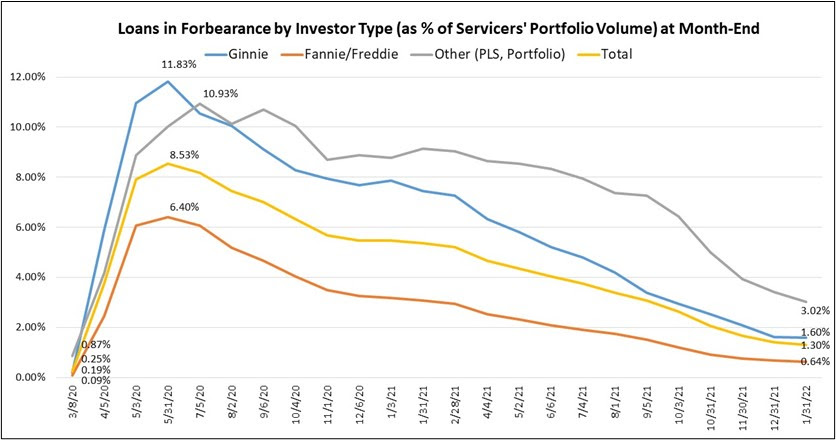

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 11 basis points from 1.41% of servicers’ portfolio volume in the prior month to 1.30% as of January 31, 2022. According to MBA’s estimate, 650,000 homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased 4 basis points to 0.68%. Ginnie Mae loans in forbearance decreased 3 basis points to 1.60%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 41 basis points to 3.02%.

“For the second straight month, the pace of forbearance exits reached another low since MBA began tracking exits in June 2020,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “There was also a pick-up in new forbearance requests and re-entries for all loans, and particularly for Ginnie Mae loans. Even though the forbearance rate continued its downward trajectory, it was the smallest monthly decline since January 2021.”

Added Walsh, “The positive news is that the percentage of borrowers who were current on their mortgage payments increased from December 2021. However, there was some deterioration in the performance of borrowers with existing loan workouts. Borrowers in loan workouts may have experienced new life events unrelated to the pandemic, or alternatively, the omicron variant may have triggered or re-triggered employment, health, or other stresses.”

Key findings of MBA’s Loan Monitoring Survey – January 1 to January 31, 2022:

- Total loans in forbearance decreased by 11 basis points in January 2022 relative to December 2021: from 1.41% to 1.30%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased relative to the prior month: from 1.63% to 1.60%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased relative to the prior month: from 0.68% to 0.64%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior month: from 3.43% to 3.02%.

- Loans in forbearance as a share of servicing portfolio volume (#) as of January 31, 2022:

- Total: 1.30% (previous month: 1.41%)

- Independent Mortgage Banks (IMBs): 1.59% (previous month: 1.66%)

- Depositories: 1.06% (previous month: 1.24%)

- By stage, 26.8% of total loans in forbearance are in the initial forbearance plan stage, while 59.5% are in a forbearance extension. The remaining 13.7% are forbearance re-entries, including re-entries with extensions.

- Of the cumulative forbearance exits for the period from June 1, 2020, through January 31, 2022, at the time of forbearance exit:

- 29.1% resulted in a loan deferral/partial claim.

- 19.3% represented borrowers who continued to make their monthly payments during their forbearance period.

- 17.0% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 14.9% resulted in a loan modification or trial loan modification.

- 11.6% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 6.8% resulted in loans paid off through either a refinance or by selling the home.

- The remaining 1.3% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

- Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) rose to 94.91% in January 2022 from 94.85% in December 2021 (on a non-seasonally adjusted basis).

- The five states with the highest share of loans that were current as a percent of servicing portfolio: Idaho, Colorado, Washington, Utah, and Oregon.

- The five states with the lowest share of loans that were current as a percent of servicing portfolio: Louisiana, Mississippi, New York, Indiana, and Illinois.

- Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts declined to 82.26% last month from 83.50% in December.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.