Marketpulse: November New Home Purchase Mortgage Applications Decreased 25.2 Percent

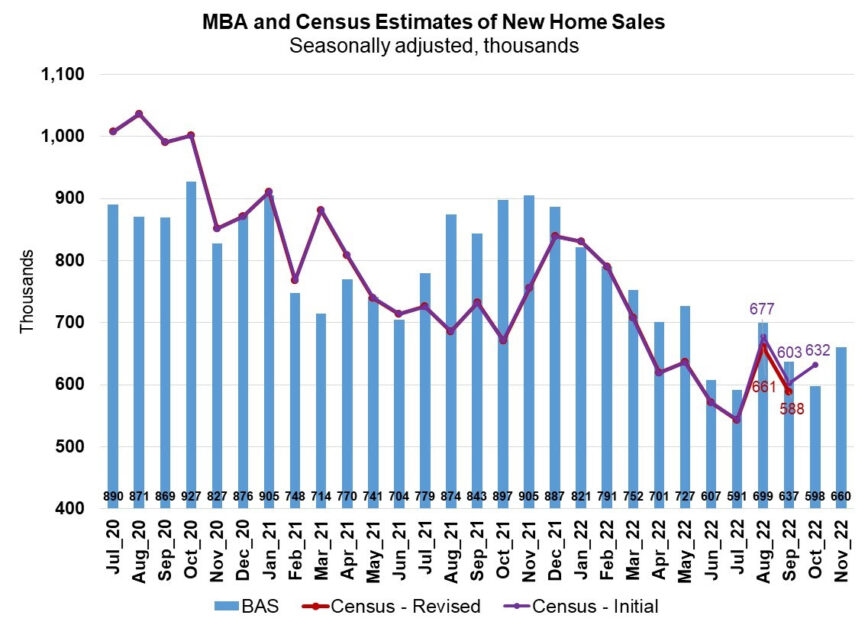

The Mortgage Bankers Association (MBA) Builder Application Survey (BAS) data for November 2022 shows mortgage applications for new home purchases decreased 25.2 percent compared from a year ago. Compared to October 2022, applications increased by 1 percent. This change does not include any adjustment for typical seasonal patterns.

“New home purchase applications recovered slightly in November, as mortgage rates retreated from their October highs and brought some prospective buyers back into a market that still faces affordability challenges,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Similarly, estimated new home sales for November saw an annual pace of 660,000 units – a 10 percent increase from October. While mortgage rates remain high compared to the past few years, the 30-year fixed rate was 6.49 percent at the end of November after reaching 7.16 percent in mid-October, providing a slight boost in purchasing power for buyers. However, both applications and sales remained over 20 percent below last year’s pace.”

Added Kan, “Reflecting the slowdown at the upper end of the market, the average loan size on new home purchase applications was $392,465, the lowest since June 2021.”

MBA estimates new single-family home sales, which has consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 660,000 units in November 2022, based on data from the BAS. The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for November is an increase of 10.4 percent from the October pace of 598,000 units. On an unadjusted basis, MBA estimates that there were 49,000 new home sales in November 2022, an increase of 4.3 percent from 47,000 new home sales in October.

By product type, conventional loans composed 67.6 percent of loan applications, FHA loans composed 21.3 percent, RHS/USDA loans composed 0.2 percent and VA loans composed 10.9 percent. The average loan size of new homes decreased from $400,616 in October to $392,465 in November.

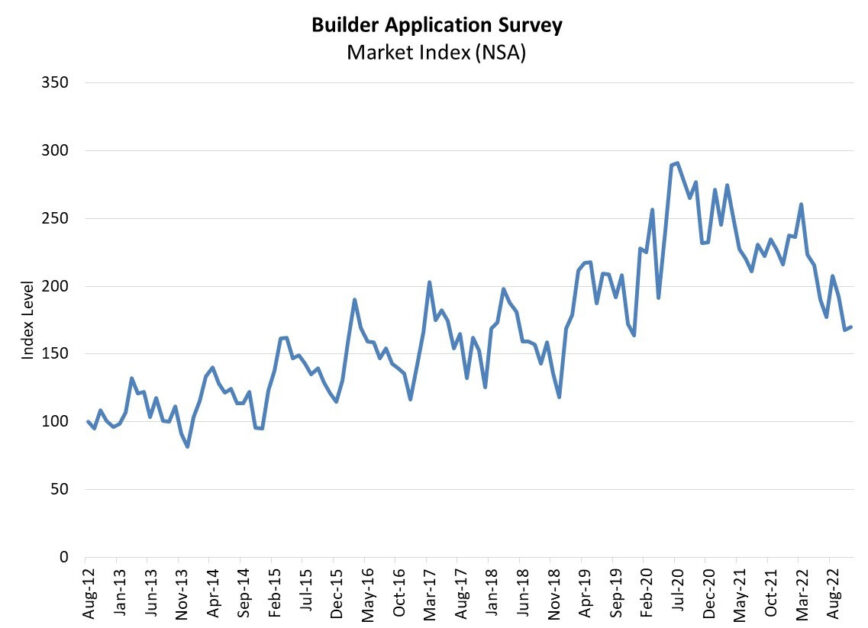

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level. This data also provides information regarding the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.