Process Improvement Column: Share Of Mortgages In Forbearance Remains Flat In November

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance remained flat relative to the prior month at 0.70% as of November 30, 2022. According to MBA’s estimate, 350,000 homeowners are in forbearance plans.

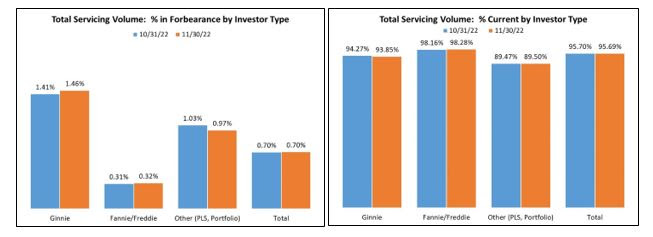

The share of Fannie Mae and Freddie Mac loans in forbearance increased 1 basis point to 0.32%. Ginnie Mae loans in forbearance increased 5 basis points to 1.46%, and the forbearance share for portfolio loans and private-label securities (PLS) declined 6 basis points to 0.97%.

“There were pockets of weakness in the November data, despite the forbearance rate remaining unchanged and the overall loan performance of serviced loans staying mostly flat,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “The forbearance rate for Ginnie Mae loans increased for the fourth consecutive month, and the overall performance of the portfolio declined for the third consecutive month. Furthermore, the performance of government post-forbearance workouts also weakened.”

Added Walsh, “With many indicators pointing to a recession and higher unemployment in 2023, many of the most vulnerable homeowners will be those with FHA, VA, or other government loans. Loss mitigation options may help to ease the financial hardship for these homeowners.”

Key Findings of MBA’s Loan Monitoring Survey – November 1 to November 30, 2022

- Total loans in forbearance remained the same in November 2022 relative to October 2022 at 0.70%.

- By investor type, the share of Ginnie Mae loans in forbearance increased relative to the prior month: from 1.41% to 1.46%.

- The share of Fannie Mae and Freddie Mac loans in forbearance increased relative to the prior month: from 0.31% to 0.32%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased relative to the prior month: from 1.03% to 0.97%.

- Loans in forbearance as a share of servicing portfolio volume (#) as of November 30, 2022:

- Total: 0.70% (previous month: 0.70%)

- Independent Mortgage Banks (IMBs): 0.95% (previous month: 0.96%)

- Depositories: 0.46% (previous month: 0.47%)

- By stage, 37.8% of total loans in forbearance are in the initial forbearance plan stage, while 50.1% are in a forbearance extension. The remaining 12.1% are forbearance re-entries, including re-entries with extensions.

- Of the cumulative forbearance exits for the period from June 1, 2020, through November 30, 2022, at the time of forbearance exit:

- 29.7% resulted in a loan deferral/partial claim.

- 18.2% represented borrowers who continued to make their monthly payments during their forbearance period.

- 17.3% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 16.0% resulted in a loan modification or trial loan modification.

- 11.0% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 6.6% resulted in loans paid off through either a refinance or by selling the home.

- The remaining 1.2% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

- Total loans serviced that were current (not delinquent or in foreclosure) as a percent of servicing portfolio volume (#) decreased slightly to 95.69% in November 2022 from 95.70% in October 2022 (on a non-seasonally adjusted basis).

- The five states with the highest share of loans that were current as a percent of servicing portfolio: Washington, Idaho, Colorado, Utah, and Oregon.

- The five states with the lowest share of loans that were current as a percent of servicing portfolio: Mississippi, Louisiana, Indiana, New York, and West Virginia.

- The share of loans that were current declined in 31 states compared to the previous month.

- Total completed loan workouts from 2020 and onward (repayment plans, loan deferrals/partial claims, loan modifications) that were current as a percent of total completed workouts decreased to 76.89% in November from 78.16% the previous month.

Tony Garritano is the founder at PROGRESS in Lending Association. As a speaker Tony has worked hard to inform executives about how technology should be a tool used to further business objectives. For over 20 years he has worked as a journalist, researcher and speaker in the mortgage technology space. Starting PROGRESS in Lending Association was the next step for someone like Tony, who has dedicated his entire career to providing mortgage executives with the information that they need to make informed technology decisions to help their businesses succeed.