Falling Home Prices And Purchase Mortgage Locks Reveal A Stagnant Late-Spring Housing Market

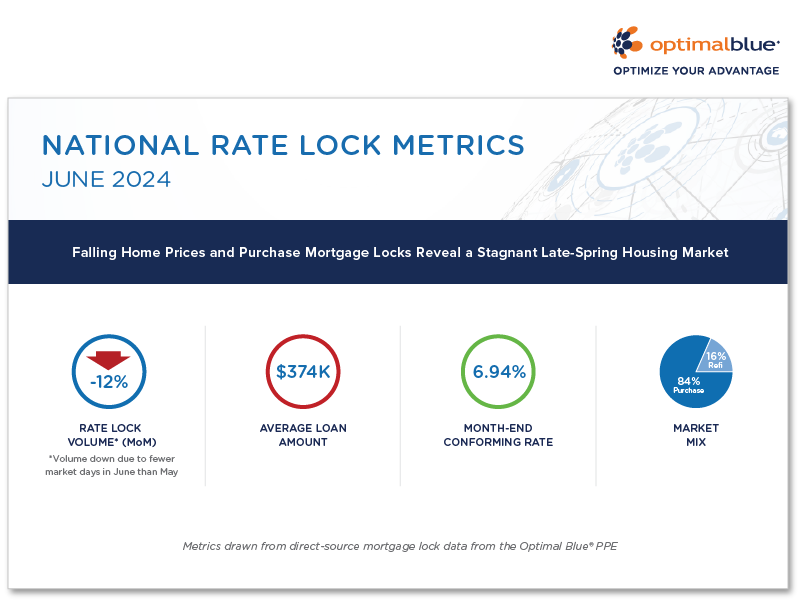

Optimal Blue released its June 2024 Market Advantage mortgage data report, which revealed a stagnant late-spring housing market as home prices dropped for the first time in 2024 and purchase lock counts fell 8% over the previous year. All mortgage lock figures in this news release have been controlled for fewer market days in June.

“Despite an improvement in interest rates, purchase activity was subdued in June. However, many homeowners with higher rates – particularly those who closed on their mortgage in the last 12 to 18 months – jumped at the opportunity to refinance, even for a small reduction in monthly payments. This behavior speaks to the ongoing inventory and affordability challenges consumers are experiencing,” said Brennan O’Connell, director of data solutions at Optimal Blue. “As we look toward the back half of 2024 and the potential for rate relief from the Fed, purchase lock counts will provide insight into if and when production will turn the corner.”

Key findings from the Market Advantage report, which are drawn from direct-source mortgage lock data are:

- Small dip in interest rates: The benchmark OBMMI 30-year conforming rate bottomed out on June 13 at 6.810% before ending the month at 6.938%, 8 bps lower than the close of May. The retreat in mortgage rates prompted a 39% MoM increase in rate-and-term refinance volume.

- Year-over-Year purchase lock counts fall: After showing a YoY increase in April, purchase lock counts – a key measure for market health that excludes the impact of home price appreciation (HPA) and volatile refinance activity – have been down for two consecutive months this spring, falling 4% YoY in May and 8% YoY in June.

- Lethargic volume despite jump in refis: Total volume was up 2% over the previous month, an incremental increase driven by a 22% jump in refinance activity. Purchase volume declined by 1% over the same time period.

- Credit remains high, but varies by locale: While average credit scores remained high across the board at 738, they varied widely among the top 20 metropolitan statistical areas (MSAs) by lock volume. The San Francisco-Oakland-Hayward MSA had the highest average credit score at 757, while Atlanta-Sandy Springs-Roswell, GA, had the lowest.

- Home prices drop for first time this year: The average home purchase price ended its five-month growth streak, dropping $1.5K, from $480.3K to $478.8K. MoM, the average loan amount declined by $300 to $374.2K.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.