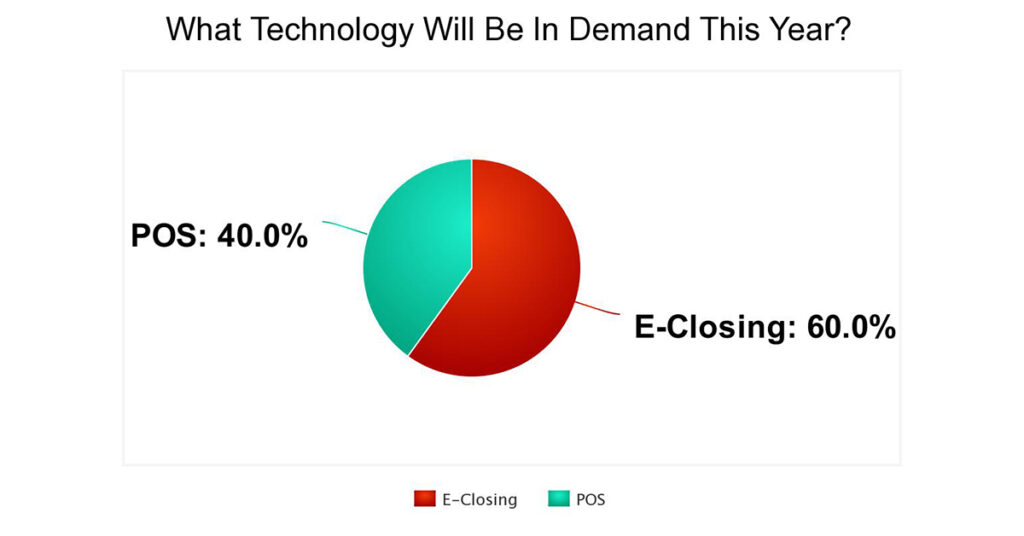

eClosing And POS Technology Is What Lenders Want

PROGRESS in Lending surveyed its 90,000 plus readers and they were split over what technology will be most sought after this year. In total, 60% of respondents said that e-closing would be hot; 40% said point-of-sale would be the technology to get and 0% said LOS or PPE technology would be in demand.

What is for sure? Lenders that embracing a more automated point-of-sale and e-closing strategy are seeing the benefits. For example, lender The Mortgage Firm (TMF) knew they had to implement digital closings when they noticed competitors were offering hybrid closings. However, their first attempt in 2018 created more work and frustration, instead of more efficient closings.

To have documents automatically annotated with eSignature fields, they needed to create templates. Sheri Nedley, The Mortgage Firm’s SVP of Loan Operations, described, “I’d have to build out a template for at least six types of packages for every state. It was ridiculously cumbersome.” They also had to manually transfer documents from their LOS, Encompass by Ellie Mae, to the digital closing technology. Then, double check that all eSignature fields were correctly placed. Two employees had to manage the time-consuming templates and clunky workflow. They needed a better solution.

TMF moved to Snapdocs’ AI technology, which automatically identifies documents that are eligible for eSigning and applies eSignature fields. Additionally, Snapdocs plugs into any LOS and document preparation provider, automatically ingesting information and documents. This enabled TMF to turn the two employees, who were managing templates, into a closer and a funder. They could now do more volume with the same amount of staff.

Despite initial plans for a slow rollout, TMF implemented Snapdocs Digital Closing Platform in only a month. After receiving great feedback from their closers, Nedley wondered “why are we even waiting?” So, they committed to a date for full adoption, when they would have 100% of their closings digitized on Snapdoc.

Similarly, by implementing and iterating on cutting-edge technologies as they arise, the University of Wisconsin Credit Union or UWCU team has been able to establish a reputation among their members as a company at the forefront of innovation. Automating the point-of-sale works.

Members are using the technology Blend provided to them at high rates and finding the features easy to navigate. In total, 83% of applications that are started online are submitted.

Since the initial implementation of Blend’s Digital Lending Platform, UWCU has grown with the platform, adding features as they’re developed. Members have been quick to adopt these features. For example, nearly 100% of members give consent for digital disclosures, which are delivered via Blend.

The most recent addition was Blend’s consumer single sign-on and asset pre-fill, which UWCU implemented to give borrowers the “show me you know me” experience they were looking for. “Many of us have always heard, you’re my primary financial institution, why do I have to provide you data when you should already have it. Well, this has solved that,” remarked Rios.

The UWCU member base quickly showed their enthusiasm for the new feature, with twice as many applicants utilizing data connectivity for assets as a result. With an improved borrower experience and six minutes shaved off the application process on average, Rios praised the feature as “a huge success story.”

Simply put, e-closing and POS technology are paying off for those lenders that are using these solutions to the fullest.

Respond to the new weekly survey HERE.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.