Marketpulse: Optimal Blue Examines Monetary Policy Impact On The Mortgage Market

U.S. monetary policy is the purview of the Federal Reserve (Fed) and is broadly responsible for the health and stability of the economy. The Federal Reserve Open Market Committee (FOMC) is the group that decides the monetary policy that the Fed will implement in order to fulfill their dual mandate of stable prices and full employment. The FOMC meets for eight regularly scheduled meetings per year. News of the FOMC’s policy decisions and their movement of the Federal Funds Rate have a significant impact on financial markets, including the mortgage market. It is therefore important to be mindful of the timing of FOMC meetings to remain protected against the potential impact of shifts in monetary policy and the resultant impact to mortgage profitability.

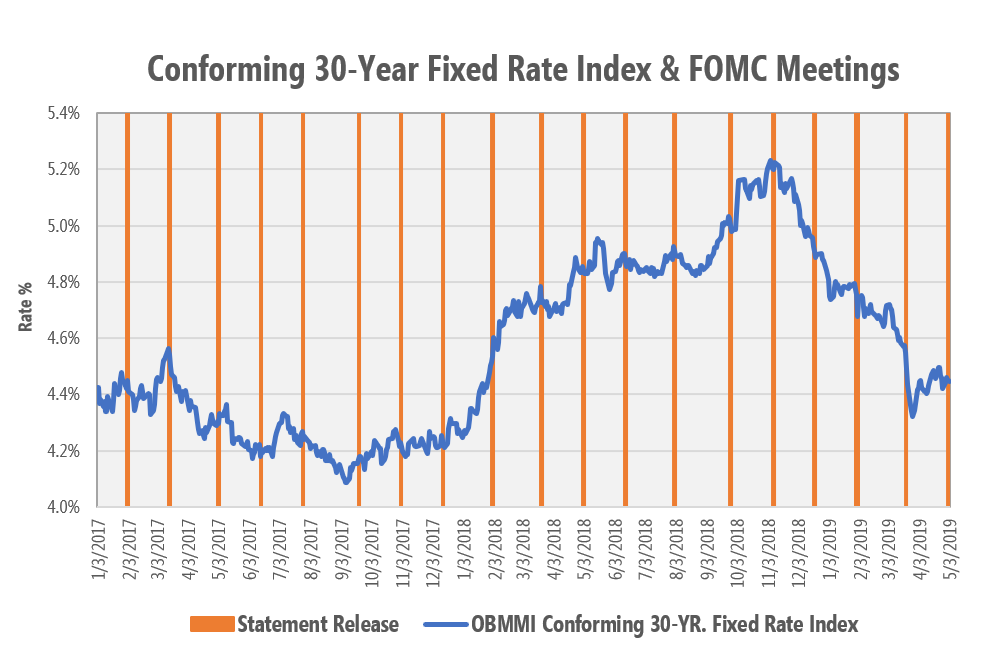

We have compared the OBMMI conforming 30-year fixed rate index against the FOMC meeting dates to measure the relative impact of monetary policy announcements. Our findings indicate that the absolute value of the percent changes the day after the announcement is 0.64%, while it is 0.41% for all other days. This shows that the announcement days are approximately 56% more volatile than all other days. The impact of the FOMC’s commentary on monetary policy and, as a result, mortgage rates, is clear as some of the largest movements over the last two years cluster around the end of FOMC meetings.

Digging a little deeper, when there is positive news for the mortgage market (rates decline), the rates on the conforming 30-year fixed mortgages move on average by -0.63% the following day, compared to an average positive day of -0.42%. Likewise, when there is negative news for the mortgage market (rates increase), the rates move on average by 0.54% the following day, compared to 0.41% on the average negative day. Furthermore, Fed news often changes the local trend of rates with the turning/pivot points happening around the FOMC news events (03/15/2017, 12/13/2017, 03/21/2018, and 11/08/2018 are a few evident examples).

Unfortunately, there’s no way to know which way the FOMC meetings are going to drive the market for any given meeting, but we do know that rate swings caused by monetary policy lead to a great deal of risk or exposure to a mortgage pipeline. This is clear as both the probability of a loan pull-through and the final loan price received on the secondary market can be significantly impacted. Consequently, a well-defined and managed mortgage pipeline hedge program is vital to the health, stability, and profitability of any enterprise with a mandatory delivery structure.

ABOUT OPTIMAL BLUE mortgage market indices

(OBMMI)

The Optimal Blue Mortgage Market Indices™ or OBMMI™ are uniquely positioned to

provide unparalleled transparency into mortgage rates by utilizing observed,

real-time lock data from approximately 30% of the market. This data is

aggregated daily and split in informative and novel ways, covering not only

conventional 30- and 15-year fixed rate indices, but also FHA, USDA, VA, and

Jumbo, as well as many Detailed Mortgage Indices of the Conventional 30 group

based on Loan-to-Value (LTV) and FICO credit score. The OBMMI deliver the most

complete, frequent, and informative view of the mortgage rate environment based

solely on observed, real-time transactions. For more information, please visit www.optimalblue.com/obmmi.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.