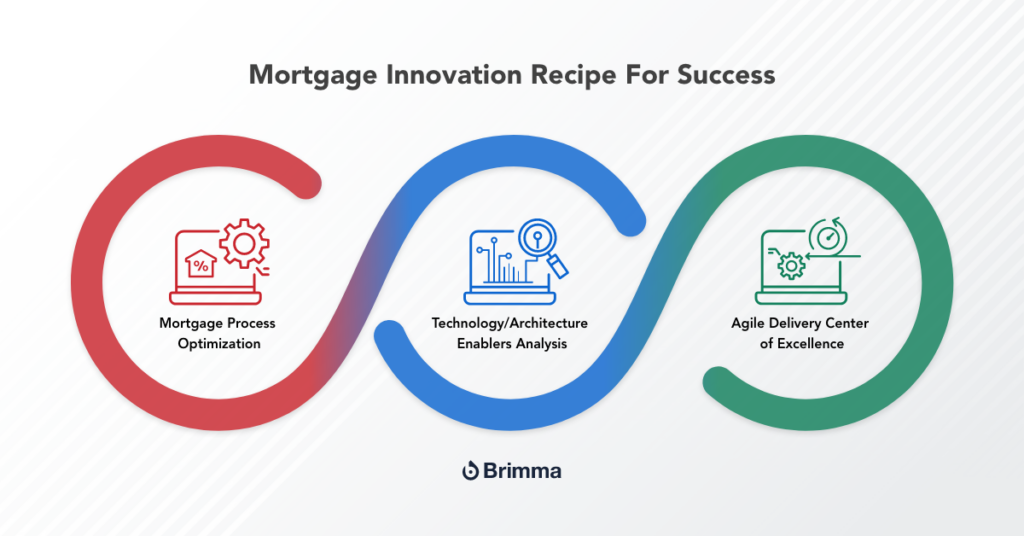

The Mortgage Innovation Success Recipe In Action

When lenders invest in an Innovation Recipe For Success the results can be astounding. Outlined below are examples of 3 lender-partners who embraced the recipe strategy and made the required investments in time, collaboration and funding to reap significant automation benefits in 4 – 12 weeks.

Client #1 Bay Equity Home Loans — RPA and Full Modern Web Platform – Realizing their legacy LOS was stable but challenging to upgrade quickly, this lender latched onto the rapid results achievable with cost effective Robotic Process Automation (RPA) tools. In week 1, the Brimma – Client teams reviewed recordings of highly manual, “clicky” processes such as sending out initial disclosures. It took between 7-8 minutes for a processor to click thru and validate data for each transaction. Over the next 3 weeks, we iterated with the Softomotive RPA platform (now Microsoft Power Automate) to continuously refine automated execution and error handling of this process, putting it into production in 6 weeks. Over the last 18 months, this one use case has automated over 50,000 disclosures, saving time, aggravation and overtime costs. Over the next 3 months 5 additional RPA use cases were added. Now a more strategic set of solutions was to be contemplated.

Once quick-hit RPA solutions were in place, the client was eager to create a robust web-platform front end that interfaces to their legacy LOS and connects to all other core platforms. Iteratively collaborating within the Agile Development model and using APIs, Webhooks and Modern UI tools, our combined teams delivered: AI – Chat Data on demand, Fully Integrated bi-directional POS – LOS workflow, real-time borrower and LO communications, a Fast Track Disclosure Validation Service, automated Settlement Service Provider Data, and an automated Vendor Ordering Platform to proactively order, monitor and notify on thousands of 3rd-party vendor orders per month.

As Sue Melnick, COO of Bay Equity puts it “The Brimma partnership has been game changing. They are able to quickly understand our process challenges and turn around integrated seamless solutions that our teams are eager to adopt. Brimma is truly unique in the mortgage technology solution space.”

Client #2 The Money Store — Realtime Mobile Rate Locks – With efficient upfront discussions about specific process friction points, the collective Brimma – Client team agreed on a Mobile First set of visual designs to quickly lock down requirements and scope. Today, the solution presents expiring rate locks, offers loan officers different extension terms, and calculates the costs to borrowers based on real-time rates. Loan Officers can proactively discuss options with borrowers in real time and execute extensions in under 1 minute.

As CFO David Zilberman of The Money Store notes, “Team Brimma has a unique understanding of mortgage processes that allow them to deliver innovations faster than I have seen before; their expertise compresses timelines, driving forward meaningful innovation that keeps us ahead of the competition”

Client #3 ReverseVision — Modern Scenario Builder for Reverse Mortgages – This client web application is targeting lenders serving senior homeowners with substantial home equity that would like to age in-place comfortably with less exposure to investment performance and reliance on fixed retirement income. The client wanted the application to make it easy for lenders to educate potential clients on the value of a reverse mortgage compared to traditional loan products. Step 1 was to integrate our teams using daily-weekly standups to drive collaboration. Brimma created a full Visual Prototype aligned to the process and used it to get feedback from real world focus groups. With feedback, the solution was iteratively refined. In parallel our teams accelerated API development to deliver the data needed to bring “Scenario Builder” to fruition. The final application was delivered to an eager client on schedule and under budget by adhering to key principles of: Process Alignment, Technology Best Practices and Agile Delivery Discipline.

CTO Jim Magner says “ The Brimma team is impressive. They turned out high quality UX-UI screens for a complex process while simultaneously building out our APIs to quickly bring an elegant solution to life”.

With the right mix of Domain Experts, Technology Knowhow and an Agile Development Center of Excellence the ability to consistently deliver game changing mortgage innovations can become a certainty.

If you want to deliver high value technology solutions for your front line teams, click HERE to connect with Brimma.

Rob Strickland is a Managing Partner at Brimma Tech Inc., a mortgage technology innovation partner for lenders seeking to deliver integrated holistic automation for their borrowers and front line operations teams.

As a Chief Revenue Officer for the past 20+ years, he leads high performing teams across Sales, Marketing and Operations to deliver solutions that align customers’ business strategies with technology enablement options to exceed stated goals.

You can email him for more information at Rob@brimmatech.com and find him here on LinkedIn https://www.linkedin.com/in/rcstrickland/