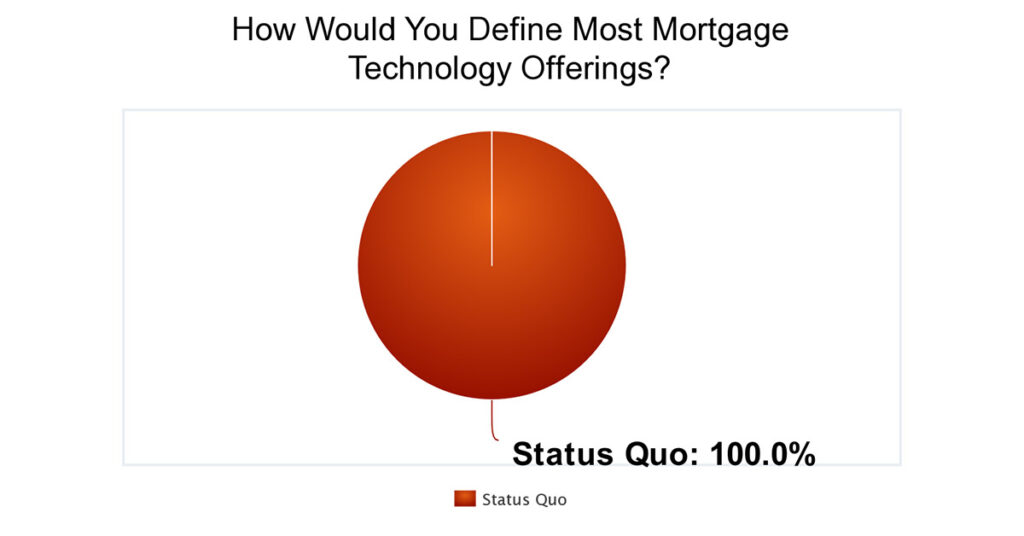

Today’s Technology Is Seen As Status Quo

PROGRESS in Lending surveyed its 90,000 plus readers and they were all united in how they saw mortgage technology. In total, 100% of respondents view current technology offerings as status quo; 0% described mortgage technology as innovative; and 0% called it outdated.

Why is that the case? It could be that lenders view the technology as middle of the road or it could be that this is the type of technology that lenders really want. Lenders don’t want new technology, they want proven technology. If technology is “proven” that means that it is commonly used. Proven technology can also be innovative, but truly innovative technology is new and looks to break boundaries.

Dating back to the mid 1990s there was a lot of buzz around eClosings. Many lenders thought this was the next frontier and that it was going mainstream in 5 to 10 years. That didn’t happen. Why? Lenders were reluctant to embrace the technology until the GSEs and other investors published eMortgage Guidelines.

Soon after the outcry for guidelines started the GSEs and other investors did publish their guidelines, but lenders still did not jump onboard. Why? Now they said they wanted to see other lenders go first. So, if you were a vendor that was all about eClosings you had to find someway to offer more “proven” technology to get lender clients and remain in business. Now with COVID-19 eClosings are finally picking up. It’s too bad that it took a global pandemic, but there is finally a lot of movement.

Why is this history on eMortgages and eClosing important to recount? Because mortgage technology is often characterized as status quo, but in some respects it has to be or else it won’t get used.

*Respond to the new weekly survey HERE.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.