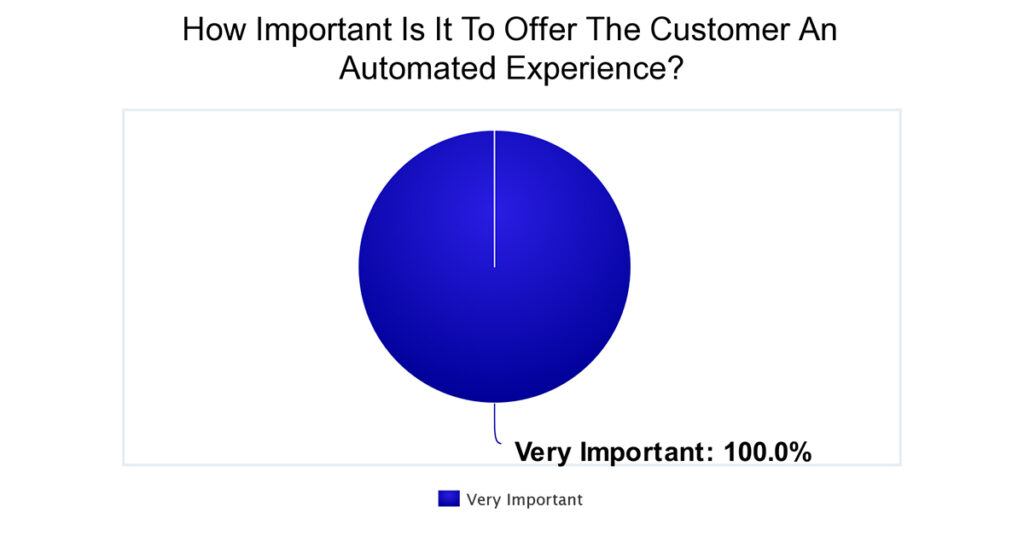

Lenders Agree They Have To Automate The Point-of-Sale

PROGRESS in Lending surveyed its 90,000 plus readers and they were all united in how they saw the customer experience. In total, 100% of respondents view offering an automated customer experience as very important.

Tech-savy lenders are seeing the benefit of offering customers an automated experience. For example, by implementing and iterating on cutting-edge technologies as they arise, the University of Wisconsin Credit Union team has been able to establish a reputation among their members as a company at the forefront of innovation.

Members are using the technology provided to them at high rates and finding the features easy to navigate. 83% of applications that are started online are submitted.

Since the initial implementation of Blend’s Digital Lending Platform, UWCU has grown with the platform, adding features as they’re developed. Members have been quick to adopt these features. For example, nearly 100% of members give consent for digital disclosures, which are delivered via Blend.

The most recent addition was Blend’s consumer single sign-on and asset pre-fill, which UWCU implemented to give borrowers the “show me you know me” experience they were looking for. “Many of us have always heard, you’re my primary financial institution, why do I have to provide you data when you should already have it. Well, this has solved that,” remarked Rios.

The UWCU member base quickly showed their enthusiasm for the new feature, with twice as many applicants utilizing data connectivity for assets as a result. With an improved borrower experience and six minutes shaved off the application process on average, Rios praised the feature as “a huge success story.”

*Respond to the new weekly survey HERE.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.