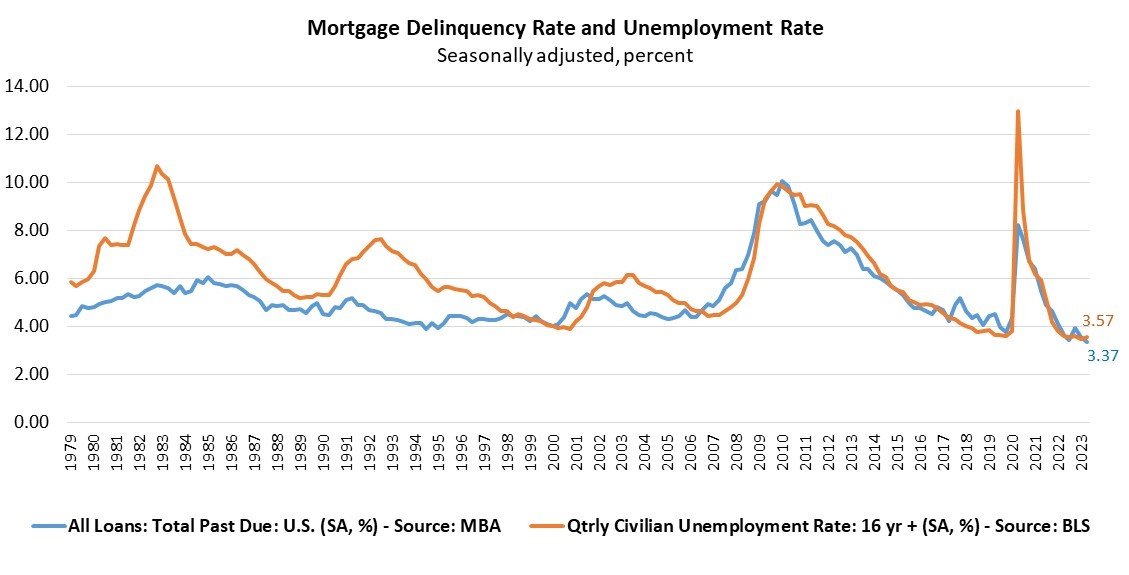

Mortgage Delinquencies Decrease In The Second Quarter Of 2023

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter of 2023, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 19 basis points from the first quarter of 2023 and down 27 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the second quarter fell by 3 basis points to 0.13 percent.

“The seasonally-adjusted mortgage delinquency rate fell to its lowest level since MBA’s survey began in 1979, reaching 3.37 percent in the second quarter of 2023,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Buoyed by a resilient job market, homeowners are continuing to make their mortgage payments.”

Walsh noted that delinquencies fell across all mortgage types – conventional, FHA, and VA. Both foreclosure starts and foreclosure inventory also declined relative to the previous quarter.

Added Walsh, “Despite low delinquency rates, there are early signs of possible consumer credit stress. Delinquencies are rising for other forms of credit such as credit cards and car loans[1]. In addition, FHA delinquencies rose 10 basis points compared to year ago levels. On a non-seasonally adjusted basis, FHA delinquencies rose 13 basis points year-over-year and 71 basis points from the first quarter of 2023. As the economy slows and labor market cools, homeowners with FHA loans are likely to feel the distress first.”

Key findings of MBA’s Second Quarter of 2023 National Delinquency Survey:

- Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 2 basis points to 1.75 percent, the 60-day delinquency rate remained unchanged at 0.55 percent, and the 90-day delinquency bucket decreased 17 basis points to 1.07 percent.

- By loan type, the total delinquency rate for conventional loans decreased 15 basis points to 2.29 percent over the previous quarter to the lowest level in the history of the survey dating back to 2004. The FHA delinquency rate decreased 32 basis points to 8.95 percent, and the VA delinquency rate decreased by 28 basis points to 3.70 percent over the previous quarter to the lowest level since the fourth quarter of 2019.

- On a year-over-year basis, total mortgage delinquencies decreased for all loans outstanding. The delinquency rate decreased by 35 basis points for conventional loans, increased 10 basis points for FHA loans and decreased 52 basis points for VA loans from the previous year.

- The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.53 percent, down 4 basis points from the first quarter of 2023 and 6 basis points lower than one year ago.

- The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.61 percent, the lowest level since the second quarter of 2000. It decreased by 12 basis points from last quarter and decreased by 51 basis points from last year. The seriously delinquent rate decreased 10 basis points for conventional loans, decreased 30 basis points for FHA loans, and decreased 11 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased by 44 basis points for conventional loans, decreased 93 basis points for FHA loans and decreased 68 basis points for VA loans.

- The five states with the largest quarterly increases in their overall non-seasonally adjusted delinquency rate were: Indiana (37 basis points), Michigan (35 basis points), Ohio (35 basis points), Pennsylvania (32 basis points), and Texas (31 basis points).

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.