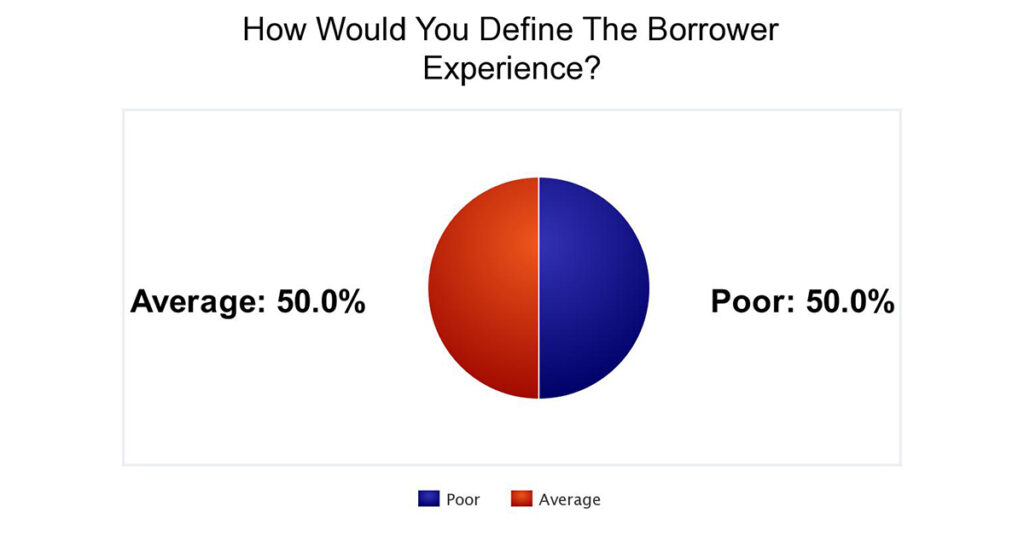

Experts Say The Borrower Experience Needs Fixing

PROGRESS in Lending surveyed its 90,000 plus readers and they were split over how to define the borrower’s experience when applying for a mortgage. In total, 50% of respondents said the borrower path is average; 50% characterized it as poor and 0% said that it is great.

“The truth is that the borrower experience varies widely depending on which lender the borrower engages with, but overall the experience is making its slow march from “awful” to “not too bad,” and getting closer and closer to “tolerable,” noted Rick Sharga, Executive Vice President at RealtyTrac.

According to research firm Raddon, borrowers were generally satisfied with their loan application experience. On a 10-point scale from Extremely Difficult (1) to Extremely Easy (10), borrowers rated the process a 7.4. However, consumers ages 18-34 who are in their prime borrowing years rated the ease of process lower at 7.2.

These findings by Raddon point to an emerging disconnect between traditional lenders and modern borrowers. Processes that may have been acceptable to older generations are proving substandard for younger borrowers who hold a different set of expectations and lenders have to adapt to this new reality.

Famed consultant Lisa Schreiber of LSK Consultants put it best when she said, “With the increased volumes, customer service has been lacking. Long wait times, blowing through locks, even though they are typically being honored. It can seem like a black hole for some borrowers.”

Respond to the new weekly survey HERE.

The Place for Lending Visionaries and Thought Leaders. We take you beyond the latest news and trends to help you grow your lending business.